Amazon has transformed from being an online bookseller to an all pervasive giant. It has disrupted industries, heightened market erosion for incumbents and built a massive commerce engine. This note looks at Amazon through the lens of a serial disruptor.

It has been almost 12 years since Amazon launched its Unbox service in the US, offering online distribution of full length movies and TV shows. To be fair, Netflix rolled out its DVD rental site in 1998, couple of years after Amazon was born. Ever since, Unbox has evolved to Video-On-Demand, then Instant Video, Video and to (paid) Prime Video now where it coexists with the Prime service that also allows (free) access to videos. From select countries, it pivoted to a worldwide launch (nearly 200 countries) in 2016.

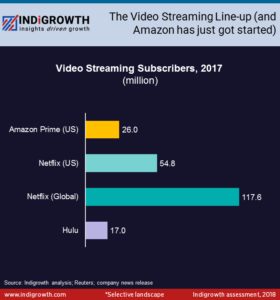

While all of the leading SVOD (streaming video-on-demand) players continue to guard their subscriber numbers, Reuters reported 26 million Amazon Prime members who streamed video content in the US. And this is not a Prime Video subscriber number, which Amazon does not release. And by comparison, Amazon Prime is estimated to have more than 100 million subscribers.

As much as this taps into the growing SVOD market that is increasingly making TV viewing redundant, it taps into the potential for online retail sales, supported by the benefits of a Prime membership. The Reuters report also found that original programming brought 5 million new subscribers to Amazon Prime.

Amazon is driving its move to a holistic streaming video provider and a replacement to the TV by following a four-pronged approach, one of which is Prime Video. Apart from reselling films and TV shows, what makes Prime Video tick is its original programming.

Enter Amazon Studio that brings original production across both series and films for exclusive viewing and early window distribution for Prime members. It became the first streaming service to win Oscars at the 2017 Academy Awards for Manchester by the Sea and The Salesman. The move to SVOD and the force of Netflix and Amazon has led to digital-only productions across the market. Amazon was estimated by J. P. Morgan to spend $4.5 billion in original programming in 2017, nearly tripling its original content on Prime Video. This compares to HBO’s $2 billion, thus making it a prime contender in the SVOD market. It was reported to have paid $250 million for The Grand Tour show from the “Top Gear” team. A $50 million deal with NFL for exclusive streaming of 10 Thursday night games. And about $250 million for rights alone to the prequel of the fantasy The Lord of the Rings series. Studio is replicating its strategy – producing films with a theatrical window – across the US, UK, Japan and India (its biggest markets). It is moving towards becoming a full-scale film studio, adding distribution to its production heft.

And then there is Prime Video Direct. Launched in 2016, this self-distribution arm allows Indies to publish on Amazon (purchase or rent) and get streamed on Prime Video, thus getting video creators consider a large audience beyond YouTube and Vimeo.

Lesser talked about but equally interesting is its Channel subscriptions. Yes, this too. Prime and Prime Video subscribers can buy subscriptions to third-party premium networks and other streaming entertainment channels like HBO, Showtime, Starz, Cinemax, etc.. Launched in 2015 as ‘Streaming Partners Program’ and now known as ‘Prime Video Channels’, it allows subscribers to access both Pay-TV and digital-only providers. And this has been extended to include access to streaming partner’s app using Amazon login. Not only does this drive prime membership (and hence retail sales), it gets the cord-cutters on to Amazon. While others players have such a third party channel play, of note, Apple is considering such an approach for its TV app. Is this working? Looks like it. Research from The Diffusion Group found Amazon Prime Channels accounts for 55% of all direct-to-consumer subscriptions!

And to round it all, there is the Fire TV and stick. That’s the streaming media device to completely replace Pay-TV with on-demand streaming. Think of it as the last mile. The cheaper, basic stick is available in more than 100 countries, bringing SVOD capabilities to TVs with HDMI slots. A Park Associates report puts Amazon’s share at 28% of U.S. broadband households, just behind Roku. It just amped this by announcing an exclusive partnership with Best Buy to offer new Fire TV edition smart TVs.

Where does all of this lead Prime Video to? It recorded a 41% Y-o-Y growth in the UK to reach 4.3 million household in 2017, just about half of Netflix footprint, but greater than 25% growth the latter gave. In India, data by IHS Markit puts it ahead of Netflix as well, with a 10% share of OTT streaming market. While pricing and first mover advantages weigh on the subscriber uptake, it is the exclusive original content (and its quality) that holds the key to supremacy in the race for SVOD pole position. Expect Prime Video to make a lot of noise, with its new boss Jennifer Salke (ex-NBC) stepping in.

Notes:

1. Amazon Studios Head Jennifer Salke On Strategy (Deadline.com, June 2018)

2. Parks Associates: Nearly 40% of U.S. Broadband Households Own a Streaming Media Player (May 2018)

3. Amazon Dominates Direct-to-Consumer TV Network Subscriptions (TDG, May 2018)

4. Amazon Prime Video’s growth outpaces Netflix in UK (The Guardian, May 2018)

5. Exclusive: Amazon’s internal numbers on Prime Video, revealed (Reuters, March 2018)

6. How Amazon has flicked Netflix in India (Quartz, February 2018)

7. HBO CEO says ‘more is not better’ as Netflix plans to spend $7 billion on content (CNBC, Oct. 2017)

8. Why Amazon is spending $4.5B on video this year (GeekWire, April 2017)